Payment Terms Clauses for Terms and Conditions Agreements

If you sell goods or services through a mobile app or a website, then you should draft and publish Terms and Conditions with comprehensive payment terms.

Payment clauses set out your policies regarding important points such as:

- When you expect people to pay

- Your accepted payment methods

- How you handle disputes

- Subscriptions and cancellations

Let's take a look at what you should include in any payments clause to ensure it provides you with the legal protections you require.

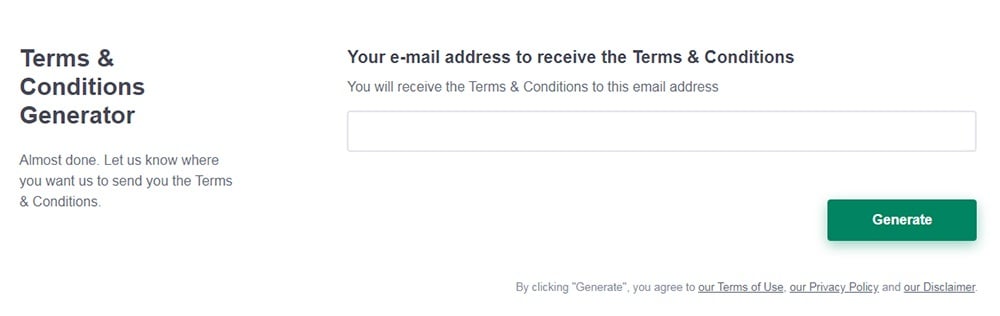

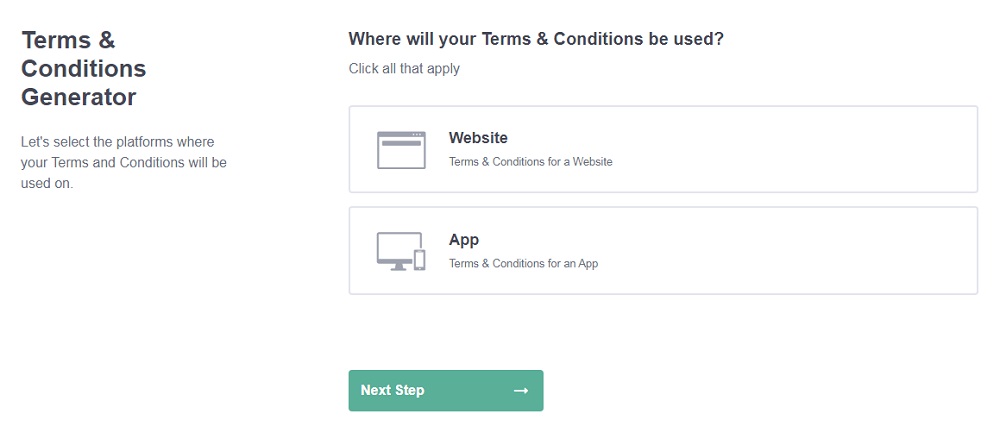

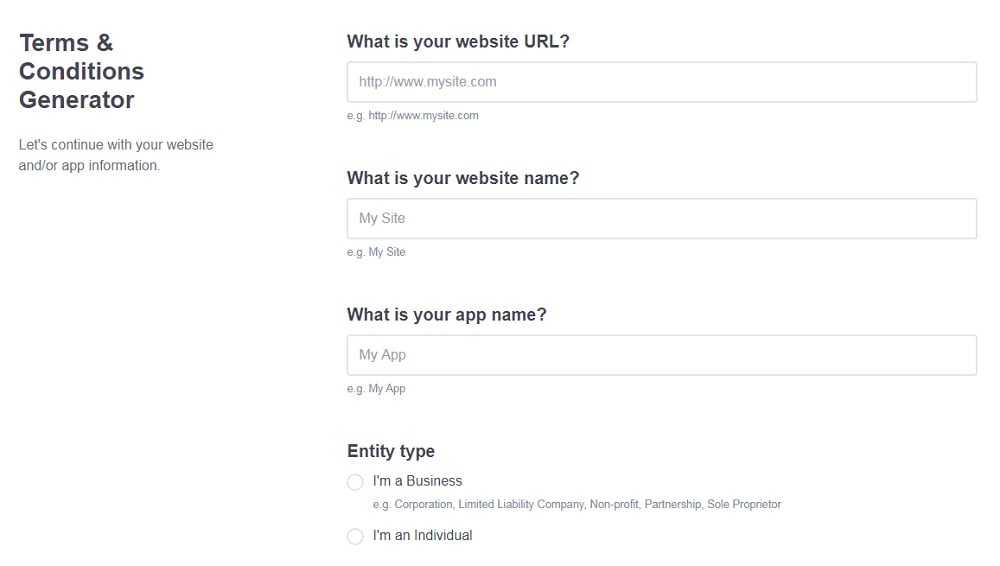

Need Terms and Conditions for your business? We can help you generate a customized Terms and Conditions agreement in around two-three minutes for free. Try our Terms and Conditions Generator and just follow these steps:

- Click on the "Create your Terms and Conditions today" button.

- At Step 1, select the where will you use your Terms & Conditions and click "Next step":

- Add information about your business:

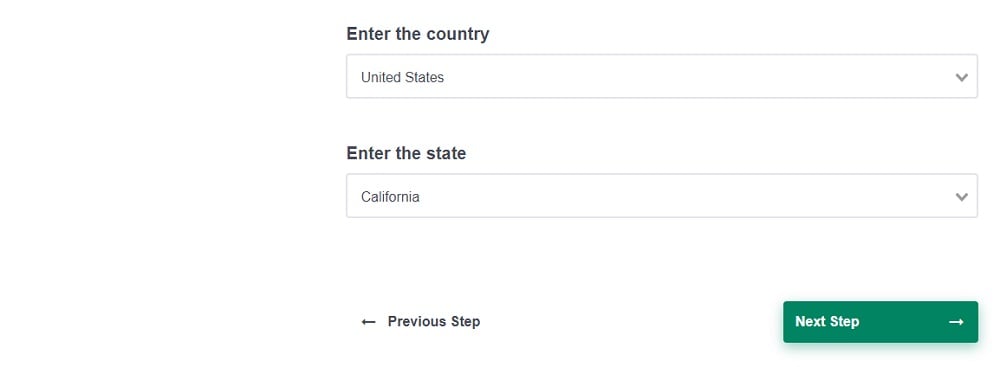

- Select the country and continue to the "Next step":

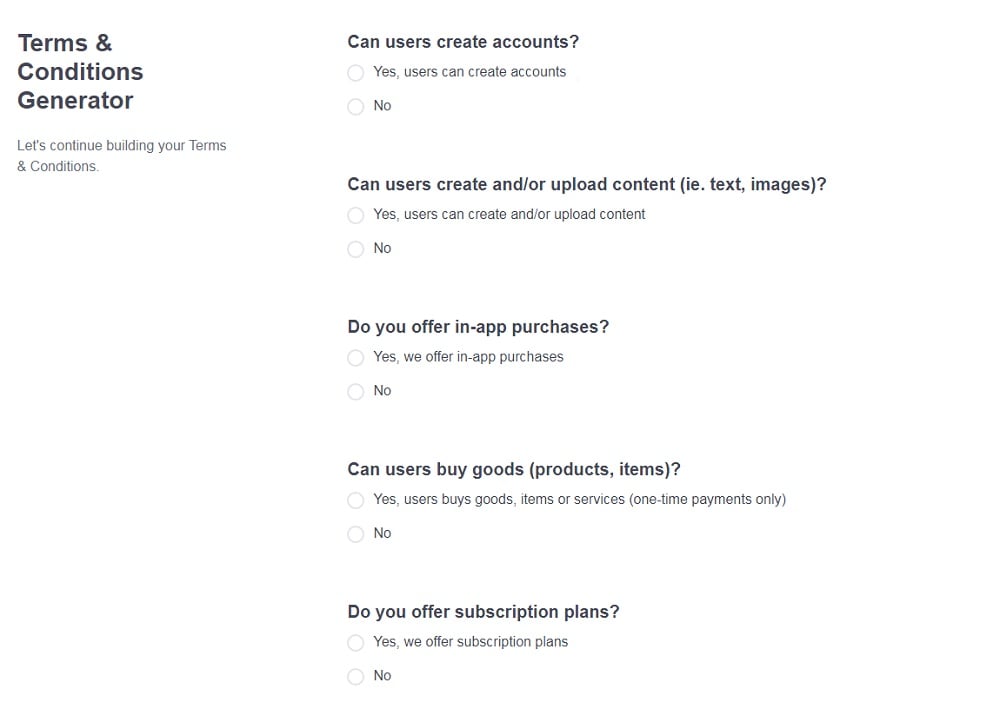

- Answer the questions about your business practices and click "Next step" when finished:

-

Enter your email address where you'd like your agreement sent and click "Generate."

You're done! Now you'll be able to instantly access and download your new agreement.

- 1. What's a Terms and Conditions Agreement?

- 2. Why You Need Payment Terms Clauses in Terms and Conditions Agreements

- 3. How to Structure a Payment Terms Clause

- 4. What to Cover in Your Payment Terms Clause

- 4.1. Payment Methods Accepted

- 4.2. Returns and Refunds Policy

- 4.3. Price Changes

- 4.4. Billings and Renewals

- 4.5. Account Suspension

- 4.6. Dispute Resolution

- 5. Conclusion

What's a Terms and Conditions Agreement?

Terms and Conditions agreements are contracts. They're a legally enforceable agreement between your business and your customers, and they give you certain rights regarding things like:

- How people can use your website

- What's protected by copyright

- When you can suspend a user's account

Why You Need Payment Terms Clauses in Terms and Conditions Agreements

There are a few simple reasons why you need a payment clause if you process customer payments:

- A payment clause allows you to set your own payment terms (so long as they comply with principles of contract law, and any applicable state or federal laws)

- Without a payment terms clause, there's no clarity over what should happen if, for example, a customer fails to settle their bill. You may lose your right to take action, or you may be restricted in what action you can take.

- If you don't have a payment clause, then customers could potentially argue that your Terms and Conditions agreement is unfair.

It's not enough simply to have a payment terms clause, though. You must ensure that it's comprehensive and covers all key points. Before we look at examples, let's consider how you might structure your clause.

How to Structure a Payment Terms Clause

While there's no "right" way to structure a payment terms clause, you should aim to ensure that it's user-friendly and easy to read.

First, consider making it easy for people to find your payment terms by providing an internal link to the relevant clause at the start of your Terms and Conditions, such as in a table of contents.

Here's an example from Zendesk of how you might set this out:

You'll also want to think about readability when you're drafting payment terms.

For example, you should aim to use clear, simple language so the average reader can understand the clause. You might also want to use bullet points rather than long sentences to highlight key points.

Atlassian uses bullet points effectively in its payment clause:

Take a look at your font and text size, too. Make sure there's a good contrast between the text color and the background e.g. a white background and black font. Ensure the text isn't too small, and check it's easy to read on mobile devices.

Finally, consider your formatting. A "wall of text" can be difficult to read, so make sure you break the clause into smaller, shorter paragraphs for maximum readability.

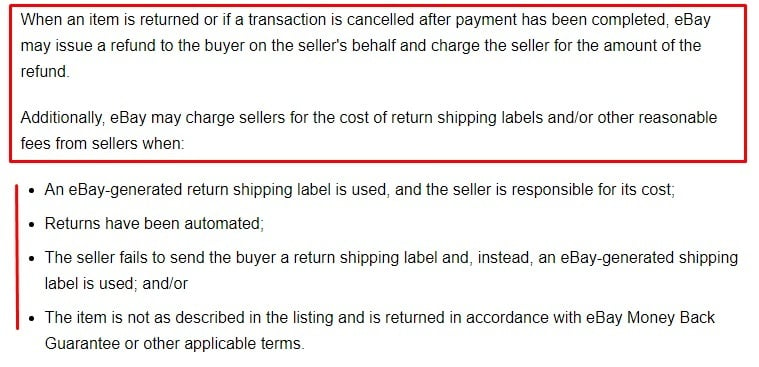

eBay, for example, uses a good blend of bullet points and concise paragraphs:

Remember, your goal is to make sure that all customers can understand your payment terms. It's one of the most critical clauses in your Terms and Conditions agreement.

What to Cover in Your Payment Terms Clause

The exact terms of payment clauses will vary from company to company. However, you should always include details on:

- Accepted payment methods

- Returns processing

- Your right to change prices

- How subscriptions are billed

- How you resolve disputes and complaints

You might also want to cover specifically what happens if a payment can't be processed, and how shipping costs are calculated, depending on your business.

Now we're clear on how payment term clauses work and what should be included, let's break down some examples of how you might include these terms in a payment clause.

Payment Methods Accepted

You might choose to only accept certain payment methods or currencies for any goods or services you sell. So, it's important that users know:

- What payment methods you will accept

- When payments fall due

- How people can update their payment details

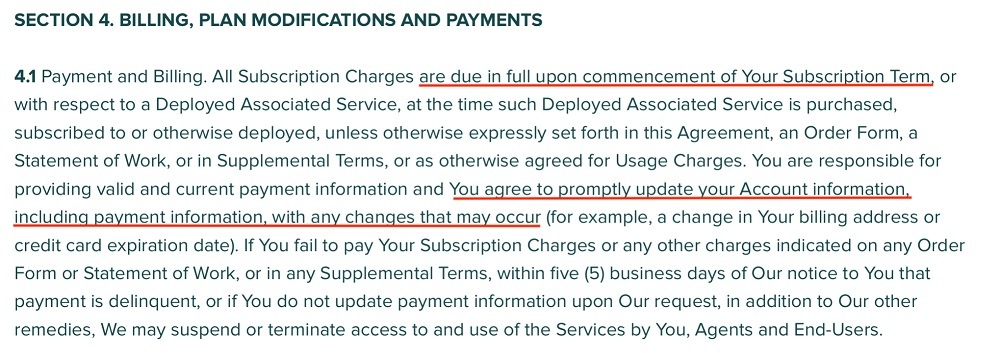

Zendesk subscribers, for example, must pay subscription charges in full when they first sign up to the service. This is helpfully set out in the first few sentences.

What's more, subscribers must also update their account information if they want to change their card details or usual payment method:

You'll note there's a lot of information in this one clause. However, it's still simple enough for the intended professional audience to understand.

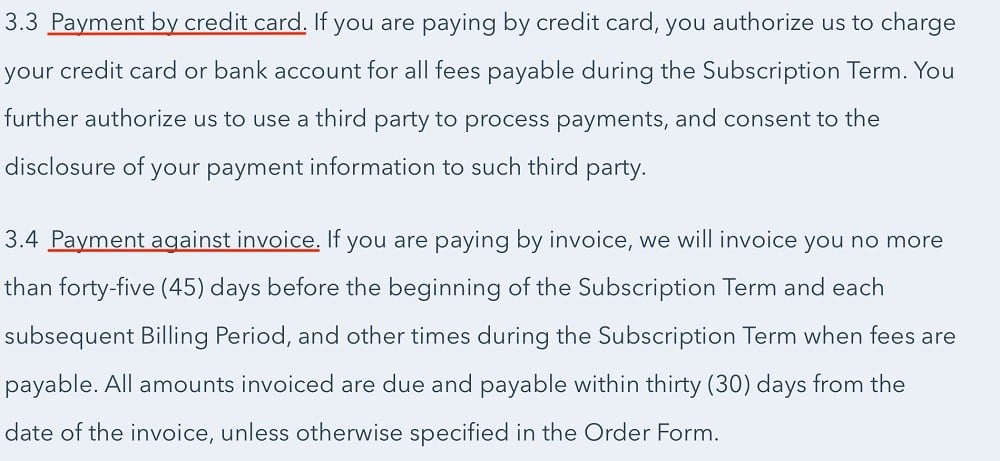

Here's an example from HubSpot. The company accepts payment either by credit card or invoice. The paragraphs are easy to skim and the language is fairly simple:

In both instances, the clauses are clear enough for subscribers to understand their payment obligations.

Returns and Refunds Policy

If you sell goods or services, then you should provide a Returns and Refunds Policy on your website.

This can either be a standalone document or set out within your T&Cs as part of your payment terms. If you don't include your policy on refunds and returns, then you could face disputes from customers which may damage your business reputation.

Your returns or refund terms should set out:

- Which sales are final

- How returns are handled

- Conditions of returns/refunds

- What costs are non-recoverable (e.g. delivery costs are rarely refundable)

HubSpot has a good example for this. According to this clause, all payments are final unless specifically allowed for by the agreement. So, thanks to this clause, the company can restrict when customers are entitled to seek refunds:

VAT, for example, is also non-refundable if customers don't provide a valid VAT number when it's required:

Again, you will note in both these examples that the wording is simple and the font is easily readable.

Atlassian also has some good examples. According to Atlassian's T&Cs, customers can't seek refunds unless it falls under the company's returns, warranty, or indemnity policies:

The clause addressing the return policy is succinct and helpful. Not only does it clearly set out when refunds may be provided, but it also reserves the right of the company to change those terms at any time. So, for example, if it decides to restrict the refund policy further, it can (so long as users are notified in advance):

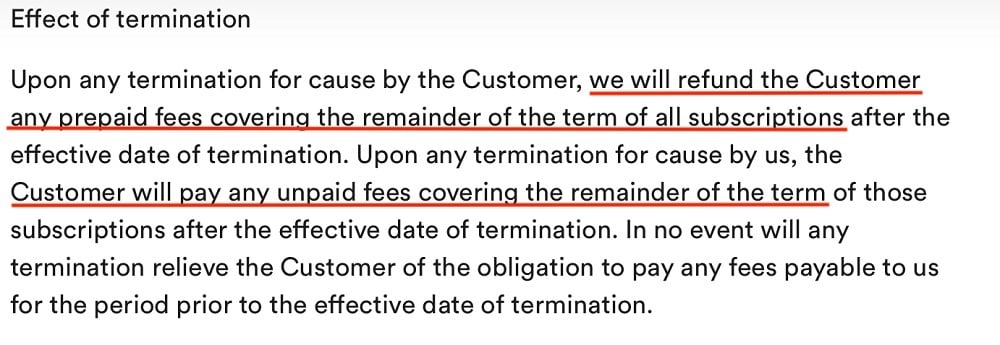

Finally, here's a short and clear example from Slack. In just a few sentences, it sets out exactly when customers may get a refund for prepaid fees, and when they might still owe the company money:

Price Changes

Sometimes it's necessary to increase your prices for the services you provide. Set out clearly:

- Your right to raise prices

- When the increase comes into effect

- What customers can do if they're unhappy with the new cost

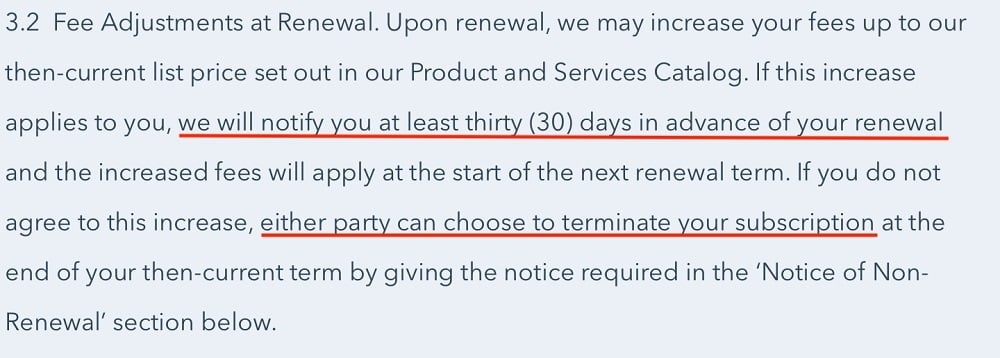

HubSpot users, for example, will be notified 30 days before any price increase comes into effect. If they don't want to pay the new rate, they can cancel. This clause is short and very easy for customers to understand:

Netflix has an even shorter and simpler clause addressing this:

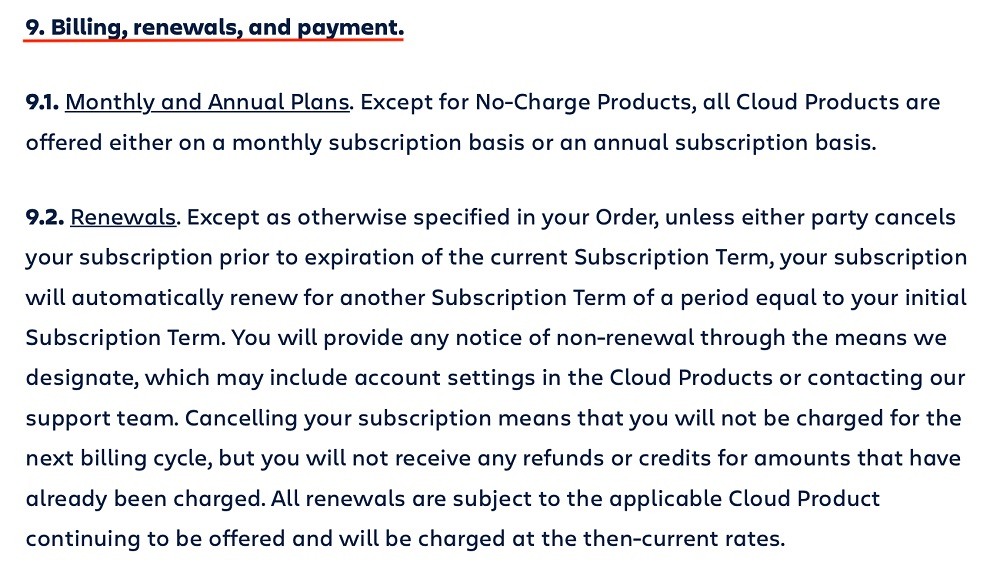

Billings and Renewals

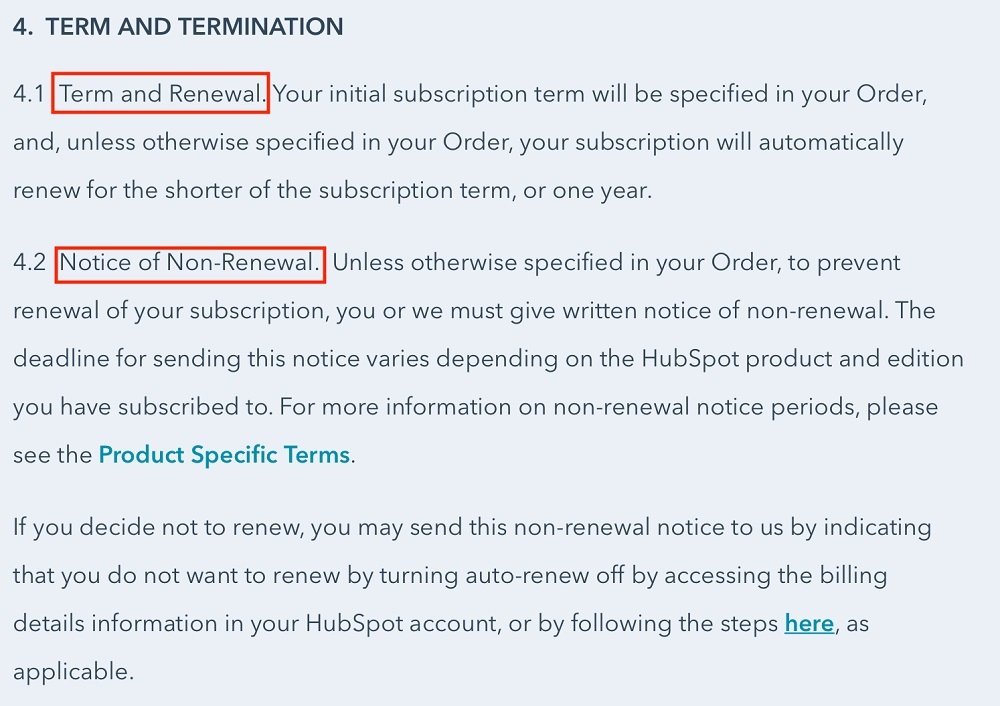

Your billing process must be clear and transparent. This part of your payment terms should cover, for example, how your billing process works, and what fees are owed if a user cancels their subscription.

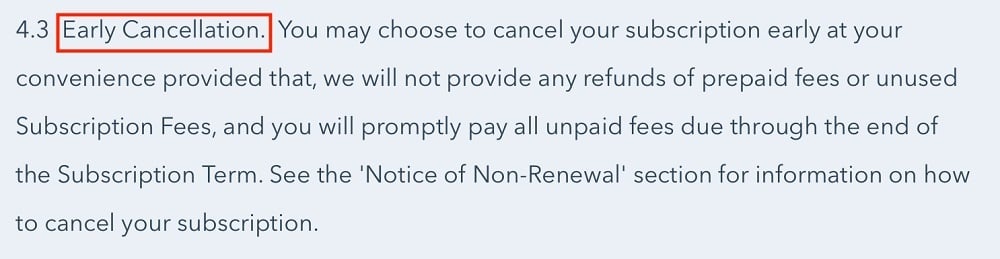

Take HubSpot as an example. It's clear that subscriptions renew automatically unless users send the company a "notice of non-renewal":

It then specifies what monies are owed if a user cancels their subscription:

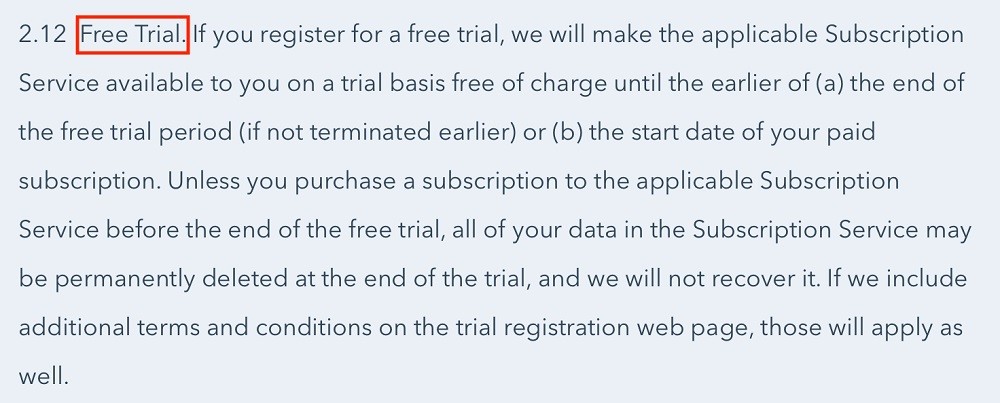

If you offer a free trial of your services, then make sure you cover what happens when the trial period ends.

Again, HubSpot has a great clause for this. It's obvious when the trial period ends and what will happen if the customer doesn't choose a paid subscription:

The clause is only a few lines long, but it covers a lot of detail, which makes it a solid example of a payment terms clause.

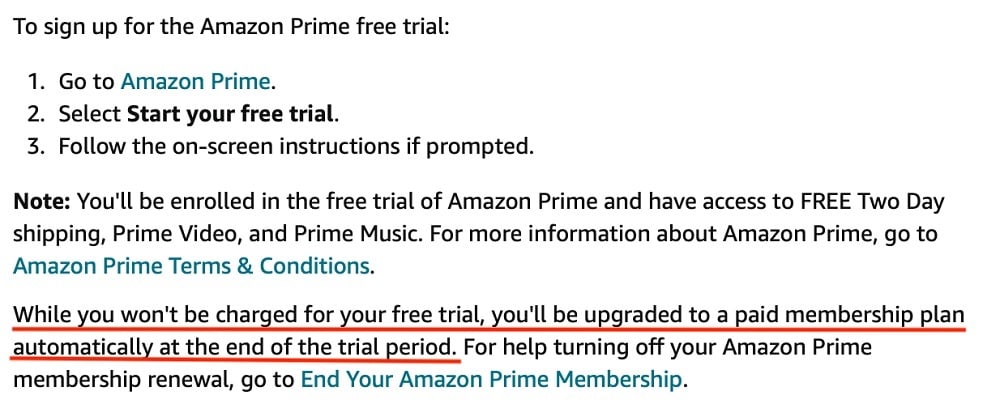

Finally, if you plan on charging customers automatically at the end of the free trial period unless they cancel first, then set this out clearly. Otherwise, customers can dispute any charge you make.

Amazon Prime sets this out well. It has separate pages dedicated to key terms in the Terms and Conditions (such as payment terms), and it also uses bullet points which makes each clause easier to read:

Account Suspension

There are many reasons why you might suspend or even end a user's account, including:

- Abusive behavior

- Copyright infringement

- Product licensing violations

From a payment perspective, you might also want to suspend a user's account if their payment falls overdue or if there's a billing issue. This will ensure that users can only access content they've paid for, and allows you to take action when a user breaks their contract with you.

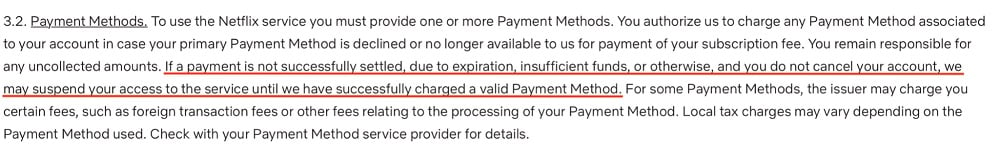

Let's consider Netflix's termination clause. It's simple: if a user doesn't pay their bill, Netflix will suspend their account until it's paid:

Helpfully, Netflix then sets out how users can change their payment method:

Again, these clauses are very simple for the average user to understand and they're set out in a logical, well-organized way.

HubSpot's clause is a little more specific. The company will notify subscribers if they haven't paid their bill, and will suspend the subscriber's account in 10 days.

It also reserves the right to impose a reactivation fee. If you plan on charging customers for late payment, it's very important you include a similar sentence:

If you don't include a sentence about reactivation fees, then a customer can challenge you for imposing this fee, and they'll most likely be successful.

Dispute Resolution

You might want to include how disputes are resolved. Payment disputes which may arise include:

- Non-payment by users or customers

- Queries over charges

- Billing issues

In many cases, it makes sense to set out your dispute resolution processes out fully elsewhere in your T&Cs to prevent your payment clauses from becoming too dense and long. However, you should touch on key points which directly relate to billing issues.

Salesforce, for example, agrees not to charge customers late payment fees or suspend an account if the customer is legitimately querying a payment issue:

Take a look at your payment terms as a whole and include clauses concerning disputes naturally throughout the content. What's most important is that your policies are clear and easily understood by the average customer.

Conclusion

If you sell goods or services to consumers, then you must ensure your Terms and Conditions, or Terms of Service, contain a payment terms clause. Although there's no legal requirement to include T&Cs on any website, it serves as a contract between you and your customers which you may rely on if something goes wrong.

Every payments clause should include, at minimum, the following information:

- Your accepted payment methods

- How returns are processed

- Your procedures for handling disputes and complaints

- How subscriptions are billed

- Your grounds for suspending or terminating someone's account

There are other things you might include, depending on the type of business you run e.g. a retail store might include a sentence or two regarding shipping and courier costs.

A failure to include a clear, comprehensive payment clause may cause problems with customers down the line if they breach your Terms and Conditions, so it's worth spending time getting your clause right.